Thursday, January 7, 2016 / Miscellaneous

The end of any year can be quite a mad rush, with Christmas and New Years coming in like a whirlwind. As our day to day activities get disrupted amidst holiday plans, family time and a myriad of other activities; it can be easy to find yourself falling into some bad or unusual habits. That strict diet that was a staple of regimen for the whole year is suddenly allowed to go a little more relaxed, as more helpings of pudding don’t seem like the end of the world. We find our selves in a bit of a no man’s…

Read More

Thursday, December 17, 2015 / Miscellaneous

It is that time of year again, and the North Pole is enjoying a surge in seasonal workers. This seasonal workforce pushed the vacancy rates on rental properties in the North Pole to an all time low, and has produced fantastic rental yields for the savvy investors who scooped up these properties. There have been reports that the housing shortage within the North Pole has lead to some serious rental increases being enjoyed by speculative investors. The difficult terrain of this arctic region makes commuting very difficult, which leads even further to the housing demand for properties that are located…

Read More

Thursday, December 17, 2015 / Property Investment

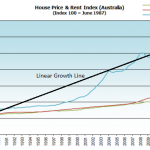

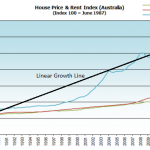

When people think about the value of their investment increasing, they have a line similar to this in mind: This is not however the natural way in which an investment will appreciate in value. Don’t get me wrong, when you balance out consistent growth over a few decades, it does become possible to draw a straight line, from the beginning to the end, such as this chart of Australian Housing prices for a 26 year period. As we can see, the black line of linear growth for a 26 year period does not match the actual growth line very…

Read More

Thursday, December 10, 2015 / Property Investment

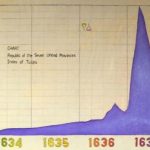

There has been a lot of talk recently about a housing bubble here in Australia. Truth be told, there has almost always been talk of a housing bubble, these comments go hand in hand with any market growth. The term bubble gets thrown around quite regularly, and we thought it may be worth having a look at the origins of the term and what it actually means. As we know a bubble is an object which rapidly grows in size, and then eventually collapses in on itself. The term of reference to a bubble when people are talking about the housing…

Read More

Thursday, December 3, 2015 / Property Investment, Property Management

Stepping into the realm of property investment goes hand in hand with becoming a landlord. The idea of being a landlord can be a thrilling, yet questioning experience for many people. Your initial experience with the rental process probably came from the other side of the spectrum; in that you may have been a tenant. Being the landlord however is a much more involved process, as you manage the leasing, the bond, and various other landlord’s responsibilities. Managing The Rental Property It comes as no surprise that the vast majority of property investors decide to hire a property manager. Whilst it…

Read More

Thursday, November 26, 2015 / Property Finance, Property Investment

Generally speaking, when someone purchases a home that they intend on living in, they get a mortgage which is then paid off over a set period of time. Each week they pay the interest on the loan amount, and then they pay off a portion of the debt itself. The portion which is paid off of the debt is called the ‘principal’. As time goes on, and more and more principal has been paid, the amount of interest that is paid each week diminishes, whilst the amount of principal that is paid each week increases. For example, if you were…

Read More

Thursday, November 19, 2015 / Property Investment

So if you have decided to buy an investment property, you are almost guaranteed to be planning on renting that property out. This is a given. Even if you have found an absolutely amazing property that seems to check every single box in what you are looking for in an investment, you’ll blow your budget pretty quickly if you can’t find a tenant. Nothing will make your property investment experience go sour and cause serious financial hardship quite as quickly as having a long term vacant property within your portfolio. Your strategy is going to be built upon the affordability of a…

Read More

Thursday, November 12, 2015 / Property Investment

When people talk about property value growth, it can become a confusing time for some. When we look at the national figures, the state figures, the city based figures and then the suburban figures; it can all become a little hazy as to exactly what growth means. The big thing to remember, is that when a figure is placed against the entire nation, then this is taking into account every single property within the country, and like wise when a state wide figure is displayed, it is once again taking into account every property within the state. Core Logic RP-data shows…

Read More

Tuesday, November 10, 2015 / Property Investment

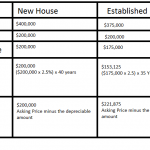

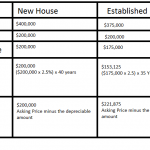

You are likely to get some very strong, very passionate responses from both sides of this debate, depending on who you speak to. There are a lot of valid reasons for each decision, and ultimately it does all come down to your individual investment strategy and the goals that you have in place. As always, this information presented is intended to be a guide only, and we recommend that you speak to a professional investment strategist to help you to come up with the best options for your goals. Reasons to Purchase Investment Property New It’s generally easier to find…

Read More

Thursday, November 5, 2015 / Property Investment

If like many Australian’s you are reading this title and thinking “but I would never catch a bus”, you should keep in mind that your sentiments are not shared by everyone else within the population. Whilst selecting the home that you are going to buy and then live in, you may not have thought too much about whether there was a convenient train line or a bus route close by. When purchasing a property for investment purposes however, it is important to consider all factors that may influence how valuable the property becomes, as well as how easy it will be…

Read More